Chapter 12 Accounting for Partnerships Test Bank

Apart from these some of the optional subjects include Entrepreneurship Mathematics Psychology Fine Arts Computer Science and Physical Education. Audit Evidence flashcards from Kia Raineys Florida International University class online or in Brainscapes iPhone or Android app.

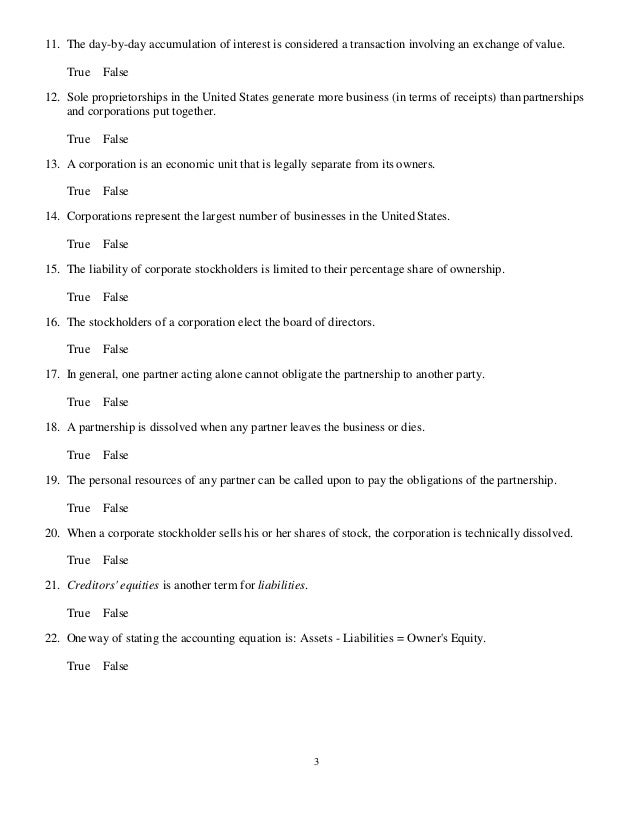

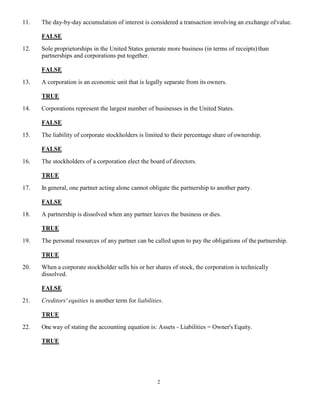

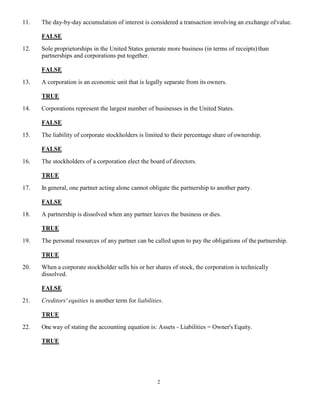

Test Bank For Principles Of Accounting 12th Edition By Needles

A Federal savings association that seeks to invest in a bank or savings association with a community development focus must comply with 16036 or any other applicable requirements.

. Chapter 12 Practice Test. Persons subject to corporation business tax not taxable under this chapter. Learn faster with spaced repetition.

Your financial accounting treatment of inventories is determined with regard to the method of accounting you use in your applicable financial statement as defined in section 451b3 or if you do not have an applicable financial statement with regard to the method of accounting you use in your books and records that have been prepared in accordance with your accounting. Which of the following is a true statement about accounting for business activities. Partnership deed is a partnership agreement between the partners of the firm which outlines the terms and conditions of the.

EVA - Virginias eProcurement Portal - eVA is Virginias online electronic procurement system. The four compulsory subjects in Classes 11 and 12 Commerce are Accounting Business Studies Economics and English. C The cash method can only be adopted by individual taxpayers.

This web-based vendor registration and purchasing system allows state agencies colleges universities and many local governments to use eVA to conduct all purchasing and sourcing activities for goods and services. These features of partnerships are documented in a document which is known as partnership deed. Determination of taxable year and method of accounting changes.

A In 2009 inDineors founders applied to TechStars which is a Boulder CO-based seed. Trust funds received or held by trustees unless otherwise provided in the instrument creating the trust and funds received or held by guardians or conservators 1 may be invested in such real estate mortgages as the savings banks in this state may be authorized by law to. You may use the formula sheet provided in the Studying for Accounting 101 chapter.

Exemption under section 12-702 not applicable to trusts or estates. B An overall accounting method is initially adopted on the first return filed for the business. A national bank that seeks to invest in a bank or savings association with a community development focus must comply with applicable requirements of 12 CFR part 24.

Study with Quizlet and memorize flashcards containing terms like inDinero the company profiled in the opening feature for Chapter 10 is described by its cofounders as the fastest way for small businesses to manage their finances Which of the following is not true about inDineros founding story. A An overall accounting method can only be adopted with the permission of the commissioner. Credits pursuant to this section may be claimed against income taxes imposed by Section 12-6-510 or 12-6-530 bank taxes imposed pursuant to Chapter 11 of this title and insurance premium taxes imposed pursuant to Chapter 7 Title 38 and are limited in use to fifty percent of the taxpayers South Carolina income tax bank tax or insurance.

Organizations may partner to increase the likelihood of each achieving their mission and to amplify their reach. Persons exempt from federal taxation exempt from taxation under this chapter. What is a Partnership Deed.

These are the core subjects. The chapters added to volume 1 of DK Goel Class 12 Accountancy are as follows Chapter 1 Accounting for Partnership Firms Fundamentals Chapter 2 Change in Profit Sharing Ratio Chapter 3 Admission of Partner Chapter 4 Retirement or Death of Partner Chapter 5 Dissolution of a Partnership Firm. Taxes payable by fiduciary.

Students need to select an eclectic subject from these optional subjects. A partnership is an arrangement where parties known as business partners agree to cooperate to advance their mutual interestsThe partners in a partnership may be individuals businesses interest-based organizations schools governments or combinations.

Test Bank For Principles Of Accounting 12th Edition By Needles

Test Bank For Principles Of Accounting 12th Edition By Needles

Test Bank For Principles Of Accounting 12th Edition By Needles

Test Bank For Principles Of Accounting 12th Edition By Needles

No comments for "Chapter 12 Accounting for Partnerships Test Bank"

Post a Comment